News

Skills USA State Competition

Winning 11 medals

Features

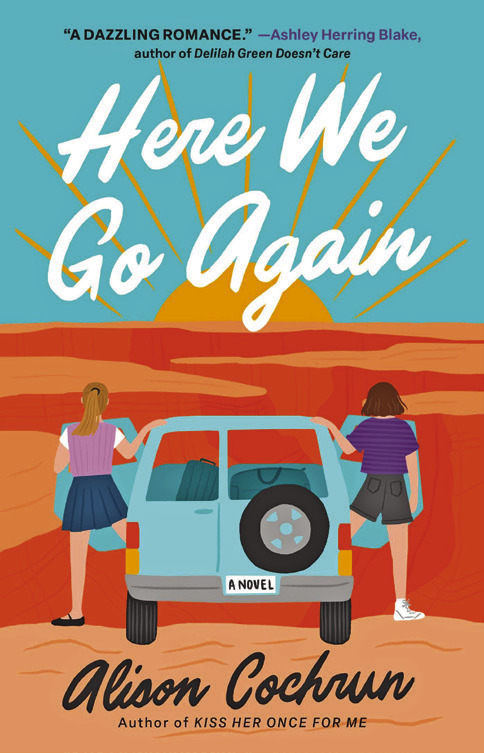

Book Review: “Here We Go Again”

Can you do me a solid? Just one little favor, a quick errand. It won’t take long.

Sports

Back in Action

Eureka Springs sophomore guard Kenner Leavell

Police

Dispatch Desk — Eureka Springs Police Department: April 2-8, 2024

Dispatch Desk for Eureka Spings Police